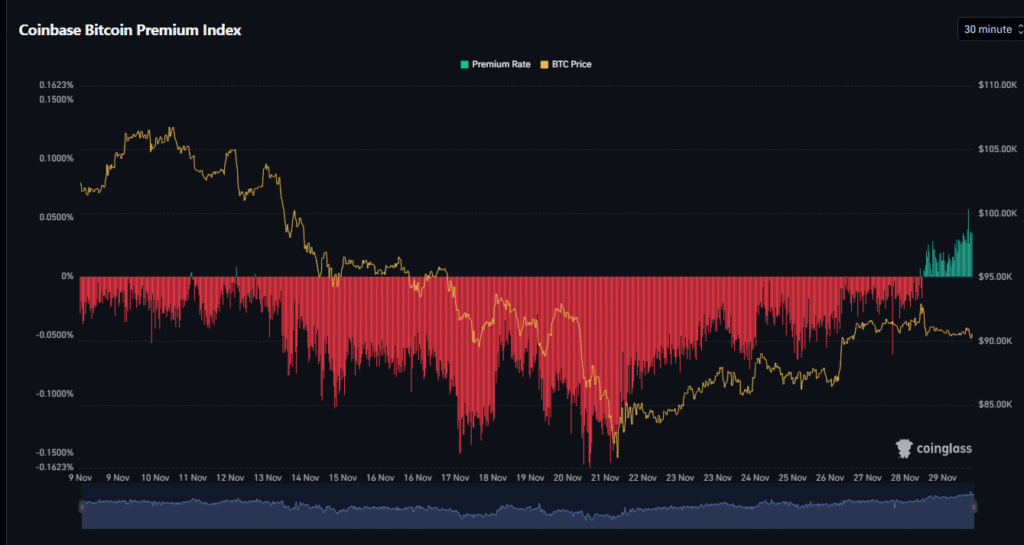

Coinbase’s Bitcoin Premium Shows That U.S. Buyers Are Back in the Game

Quick Answers

- The Coinbase Bitcoin Premium Index, which shows how much more Bitcoin costs on Coinbase than on other exchanges around the world, has turned positive after being negative for almost a month.

- A positive premium usually means that U.S. investors, both institutional and retail, are buying more, which can drive up the price of Bitcoin.

- Bitcoin is trading at about $91,000, which is up from recent lows below $90,000.

- This change comes with record high stablecoin balances on exchanges like Binance, which have $51.1 billion. This suggests that more money is ready to enter the market.

- Analysts think this is a sign of recovery, but Bitcoin needs to break above $95,000 to show that it is going up strongly.

Data Source:https://www.coinglass.com/pro/i/coinbase-bitcoin-premium-index

Bitcoin’s market has been going up and down a lot lately, but a key sign just turned green for possible growth. The Coinbase Premium, which shows how much more (or less) people pay for Bitcoin on the U.S.-based Coinbase exchange compared to other places, has gone back to being positive. This hasn’t happened since the end of October, and it’s making traders very excited.

The Coinbase Premium is like a thermometer for how much people in the U.S. want to buy Bitcoin. When it’s positive, it means that people who buy Bitcoin on Coinbase—usually big institutions or regular Americans—are willing to pay a little more for it. This could mean that new money is coming in from the U.S., which has led to big rallies in the past. When it’s negative, on the other hand, it means that those same groups are either selling or being careful.

Data from sites like CoinGlass shows that this premium turned positive on shorter time frames, like the one-hour chart, ending weeks of being in the red. It’s a small but important change, especially since Bitcoin’s price went down because of market worries.

Bitcoin itself is coming back, trading around $91,000 during Asian hours. That’s a rise from lows of about $87,000, but it’s still testing important levels. We could see more upward movement if it goes above $95,000. If it drops below $87,000, though, $80,000 might come into play. Technical signs, such as a bullish MACD crossover on daily charts, make people more hopeful.

Stablecoins are another good thing. This month, Binance had a record $51.1 billion in balances, which means there is a lot of cash-like crypto ready to buy. Options markets are also resetting, and there is less fear of big drops, which sets the stage for growth.